British Pound falls as May plans fresh sattelment for Brexit

London : The pound dropped today following weak UK construction data and as Prime Minister Theresa May seeks to try and finally unlock the Brexit stalemate.

London’s benchmark FTSE 100 index, featuring large multinationals earning in dollars and euros, climbed to a two-month high above 7,000 points thanks to the weaker pound.

Eurozone stock markets faltered, while Asia mostly advanced.

Oil prices fell after hitting the highest levels this year as the crisis in OPEC producer Venezuela fuelled concerns over potential tighter crude supplies.

“A minor decline for the pound, one that followed a 10- month low UK construction PMI… allowed the FTSE to hit a fresh two-month high,” noted Connor Campbell, financial analyst at Spreadex traders.

The IHS Markit/CIPS UK Construction purchasing managers’ index fell to 50.6 in January from 52.8 the previous month.

‘Snuffed out recovery’

“Uncertainty about Brexit has snuffed out the recovery in the construction sector,” said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“In the unlikely event of a no-deal Brexit, the sector likely will slide into another recession, amid weaker business confidence and tighter credit conditions.

“But provided a deal is signed off, the construction sector likely will enjoy strong growth soon.

“Business investment should rebound later this year, given that firms’ profit margins are relatively healthy and their balance sheets are awash with cash,” Tombs added.

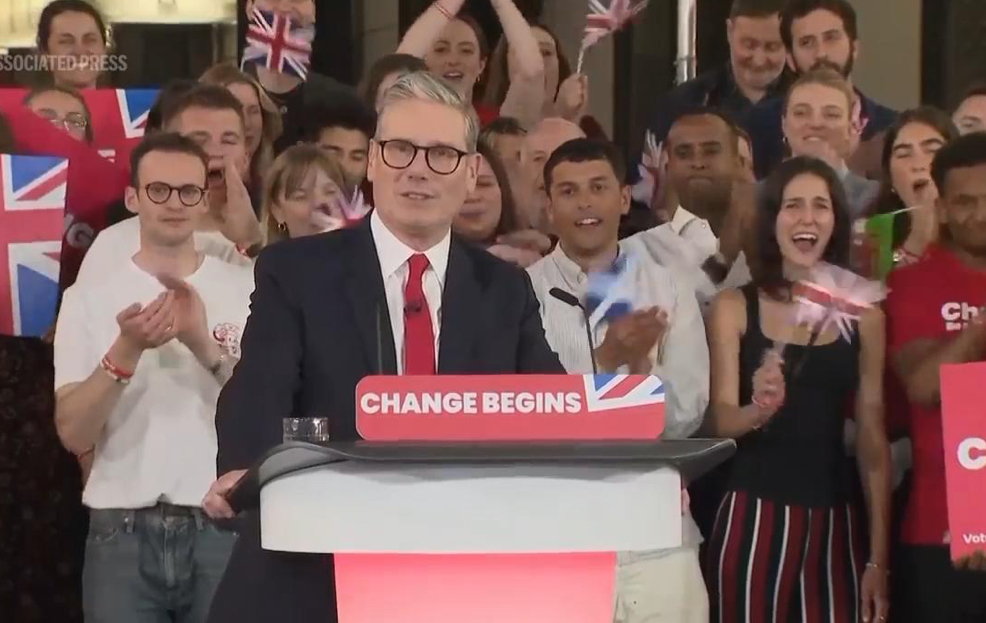

May on Sunday said she would be “armed with a fresh mandate and new ideas” when she next meets European Union negotiators over her Brexit deal.

EU officials have insisted that the deal—rejected by British lawmakers—is not open for renegotiation.

But May wrote in the Sunday Telegraph that she would be “battling for Britain and Northern Ireland” in her efforts to get rid of the agreement’s unpopular “backstop” provision.

The so-called backstop is intended to ensure there is no return to a hard border with Ireland, but Brexit supporters fear it will keep Britain tied to the EU’s customs rules.

US markets opened flat, with Briefing.com analyst Patrick O’Hare saying there was little news to push stocks either way.

“There hasn’t been anything in the headlines to make much of a difference with respect to broad market sentiment,” said O’Hare.

Expectations that the Federal Reserve will take its foot off the gas in raising US interest rates—and optimism that China and the United States will eventually hammer out a deal to resolve their long-running trade war—provided support. — AFP

Facebook Comments